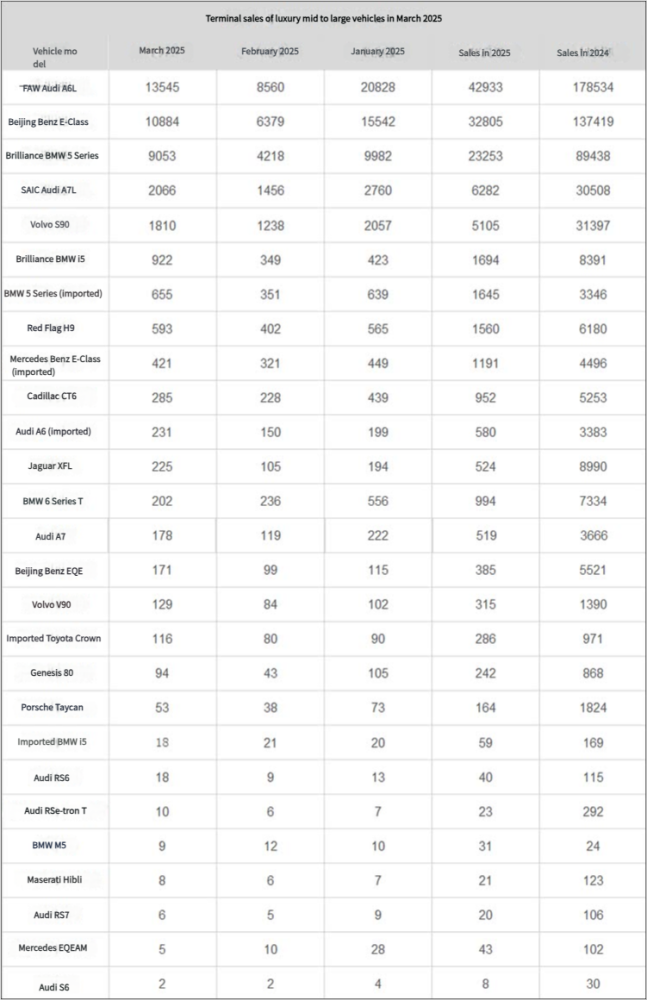

China March 2025 Luxury Sedan Sales Report

March 2025 Premium Mid-to-Large Sedan Market Sales & Pricing Analysis

Market Overview: Luxury Going Mainstream

With continuous price reductions, the premium mid-to-large sedan segment is becoming increasingly accessible to mainstream buyers. Several models have now dropped below the 300,000 RMB threshold (approximately $41,400 at CNY/USD 7.25), offering exceptional value. German brands continue to dominate this segment, though newcomers like the SAIC Audi A7L are challenging established players like Volvo S90 with competitive pricing and comprehensive capabilities.

Sales Performance by Key Models

German Dominance: The Big Three Lead

- FAW Audi A6L

March sales: 13,545 units | Q1 2025 total: 42,933 units

Current A6L maintains market leadership through aggressive discounts ahead of next-gen model launch - Beijing Mercedes-Benz E-Class

March sales: 10,000+ units | Q1 2025 total: 32,805 units

Stable performance during model transition period - BMW Brilliance 5 Series

March sales: 9,053 units | Q1 2025 total: 23,253 units

Controversial design language impacts market share compared to A6L and E-Class

Second Tier: Audi A7L Emerges as Strong Contender

- SAIC Audi A7L

March sales: 2,066 units | Q1 2025 total: 6,282 units

Outperforms Volvo S90 through brand appeal and dealer discounts - Volvo S90

March sales: 1,801 units | Q1 2025 total: 5,105 units

Remains core import alternative despite A7L challenge - Hongqi H9

March sales: 593 units | Q1 2025 total: 1,560 units

Significantly below initial launch performance - Cadillac CT6 & Jaguar XFL

CT6: 285 units (March) | 952 units (Q1)

XFL: 225 units (March) | 524 units (Q1)

Despite competitive pricing, market acceptance remains limited

Import Model Performance

- BMW 5 Series (Import)

March sales: 655 units | Q1 2025 total: 1,645 units

Wagon variant could boost performance - Mercedes-Benz E-Class (Import)

March sales: 421 units | Q1 2025 total: 1,191 units

Satisfactory performance for niche offering - Audi A6 Avant

March sales: 231 units | Q1 2025 total: 580 units

Remains specialized niche product

Japanese & Korean Luxury Models

- Toyota Crown

March sales: 116 units | Q1 2025 total: 286 units

Limited market presence - Genesis G80

March sales: 94 units | Q1 2025 total: 242 units

Strong product undermined by brand recognition issues

New Energy Vehicle Highlights

- BMW Brilliance i5

March sales: 922 units | Q1 2025 total: 1,694 units

Competitive pricing drives strong performance - Beijing Mercedes-Benz EQE

Q1 2025 total: 385 units

Underwhelming market response - Porsche Taycan

March sales: 53 units | Q1 2025 total: 164 units

Limited demand for premium electric sedans

Key Models: Specifications & Pricing Comparison (March 2025)

| Model | March Sales | Q1 2025 Total | MSRP Range |

|---|---|---|---|

| Audi A6L | 13,545 | 42,933 | 419,800-656,800 RMB ($57,900-90,600) |

| Mercedes-Benz E-Class | ~10,000 | 32,805 | 443,500-654,100 RMB ($61,200-90,300) |

| BMW 5 Series | 9,053 | 23,253 | 439,900-643,900 RMB ($60,700-88,800) |

| Audi A7L | 2,066 | 6,282 | 418,700-699,700 RMB ($57,800-96,500) |

| Volvo S90 | 1,801 | 5,105 | 406,900-505,900 RMB ($56,100-70,000) |

| Hongqi H9 | 593 | 1,560 | 329,800-539,800 RMB ($45,500-74,500) |

| BMW i5 (EV) | 922 | 1,694 | 439,900-499,900 RMB ($60,700-69,000) |

| Mercedes-Benz EQE (EV) | - | 385 | 478,000-534,300 RMB ($65,900-73,700) |

Note: MSRP for reference only - substantial dealer discounts available

Market Trends Summary

- German brands maintain strong leadership with combined monthly sales exceeding 30,000 units for A6L, E-Class and 5 Series

- Effective price points now approaching/below 300,000 RMB ($41,400), accelerating luxury democratization

- Domestic NEV models like BMW i5 showing promise, though premium EVs (e.g. Taycan) face adoption challenges

- Second-tier and import models generally underperform, with brand strength determining market position

The premium mid-to-large sedan market shows established brand hierarchies with emerging NEV trends. Price reductions and dealer incentives are rapidly bringing luxury vehicles within reach of mainstream consumers worldwide.